If buying your first home is on the horizon, you’re likely thinking about saving for the costs associated with this life-changing purchase. At the top of your list is probably your down payment—an expense that many prospective buyers find intimidating, often due to misconceptions about how much is required.

Here’s the truth: You may not need a 20% down payment to buy a home. Clearing up this myth could bring you closer to owning your dream home sooner than you think.

The 20% Down Payment Myth

The idea that you need a 20% down payment is one of the most persistent misconceptions in real estate. According to the National Association of Realtors (NAR):

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

Similarly, a recent survey by Freddie Mac revealed:

“Nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

The reality is far more encouraging. Unless required by your loan type or lender, a 20% down payment isn’t mandatory. In fact, the median down payment for all homebuyers in 2023 was just 13%, according to updated NAR data. For first-time homebuyers, the median drops even lower to 6%.

How Much Do Buyers Actually Put Down?

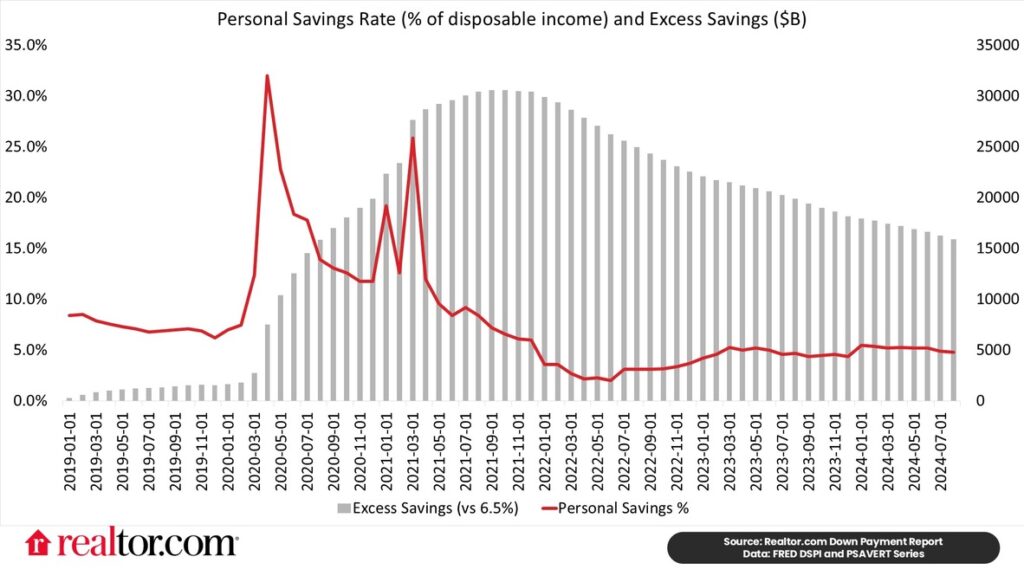

The following graph illustrates how down payments vary by buyer type:

This data shows that first-time buyers are putting down significantly less than the commonly assumed 20%, making homeownership more attainable than many realize.

Programs That Can Help You Save Toward Your Down Payment

Beyond the misconceptions about down payment amounts, there’s also confusion about down payment assistance programs. These resources are not just for first-time buyers—repeat buyers can benefit, too.

According to Down Payment Resource, there are over 2,300 homebuyer assistance programs in the U.S., most of which are designed to help with down payments. Even better, 38% of these programs are available to repeat buyerswho haven’t owned a home in the last three years.

Here are some options to consider:

- FHA Loans: Require as little as 3.5% down.

- VA Loans: Offer qualified veterans and active-duty military members a zero-down payment option.

- USDA Loans: Provide zero-down payment opportunities for buyers in eligible rural areas.

The Benefits of Lower Down Payments

A smaller down payment can help you achieve homeownership faster. Here’s how:

- Preserve Your Savings: You won’t have to deplete your savings, leaving funds available for emergencies or home improvements.

- Enter the Market Sooner: With a lower upfront cost, you can take advantage of current market conditions instead of waiting to save more.

- Benefit from Assistance Programs: By leveraging grants and loans, you can reduce the financial burden of your down payment even further.

Take the Next Step Toward Homeownership

Saving for a down payment doesn’t have to be overwhelming. Start by:

- Researching Assistance Programs: Check resources like Down Payment Resource to explore programs in Pennsylvania.

- Connecting with a Trusted Lender: A knowledgeable lender can walk you through your options and help determine what works best for your budget and goals.

- Working with a Local Expert: A real estate agent familiar with Peters Township and the surrounding Pittsburgh area can guide you toward homes that fit your financial plan.

Bottom Line

You don’t need a 20% down payment to buy a home. Programs and loan options are available to make homeownership more accessible, whether you’re a first-time buyer or looking to re-enter the market.

If purchasing a home in Peters Township, PA is part of your 2024 goals, let’s connect. Together, we’ll explore your options and take the first steps toward making your dream home a reality.